SHARE

DEEPAK MOHONI'S EVIDENCE-BASED ONLINE COURSE

Trading & Investing Strategies

Research Backed · Personal Guidance · Permanent Toolkit

Plan investments for child's education, retirement, FIRE, and other goals with research-backed strategies

Perfect for both beginners and experienced traders -- learn at your own pace

Get one-on-one guidance from Deepak Mohoni -- who coined the term Sensex and has trained over 3,000 investors

Investor Toolkit -- powerful spreadsheets with live market data that will work forever

Most traders lose as they do not know what works or how much to trade. Learn robust strategies and proper money management

Start learning immediately after registration!

REGISTER NOWWHY THIS COURSE IS DIFFERENT

Typical courses are topic-based. This course is built on validated research

We adopted a radical, evidence-based approach because 90% of traders lose money.

Individual investors may fare better, but rarely beat professionally managed funds.

However, even these funds fail to beat the market!

Such findings are vital,

yet often overlooked in books, talks, and courses.

As a result, investors often blame themselves for not doing better,

but are they really at fault?

Sources:

🔗

CNBC: Most day traders lose money (worldwide)

🔗

IFA: Active Fund Managers vs. Indexes - Analyzing SPIVA Scorecards

Investors and traders have read books, watched videos, and explored popular practices. Such material is usually insightful and motivating, but applying these ideas in real market conditions is a different proposition. Here’s why:

- ■ Popular tactics rarely prepare you for the chaos of real markets.

- ■ Vague advice leaves execution unclear—for instance, “buy low, sell high.”

- ■ No feedback loop—you don’t know if a failure was due to a mistake, or bad luck.

- ■ Many approaches rely on claims, untested by rigorous research.

Scholarly studies are the only reliable way to prove a strategy’s effectiveness and understand how to use it correctly. Too often, academic research gets a bad rap because its findings clash with product sales. Yet, some of the sharpest investing minds—Jim Simons, Graham, Scholes, and Swensen—built real-world fortunes from it.📚

This course builds on that research, simplified for practical use. It also fully leverages advantages retail investors have over professionals—for instance, the freedom to hold stocks indefinitely, adjust strategies, or invest in illiquid stocks. Some ideas—mainly around trading—are intuitive and subjective, so not suited to academic testing. Wherever that’s the case, it’s made clear. The result is a sharper course, built on a more precise, less-trodden path.

- Develop realistic expectations about trading and investing outcomes using the most trustworthy source - scholarly research.

- Learn how to allocate across index funds, managed investments (like MFs), and stock-picking. Decide whether trading suits your goals. Plan for retirement or FIRE.

- Explore clips and writings directly from legendary investors, Nobel laureates, and other visionaries - not distortions of their ideas.

- Learn why skilled fund managers struggle to beat the index, while individual investors have an edge because of fewer constraints.

- Harness the power of Google Sheets to analyze historical and live market data, with ready-to-use templates that you can use forever.

- Learn which Technical Analysis methods work and which don’t. Master risk and money management for robust trades.

- Learn Options from scratch. Use the Black-Scholes model to evaluate trades. Understand the hidden danger of high tail risk associated with selling options. Spot opportunistic options trades.

- Understand powerful ideas from academic research: how the Efficient Market Hypothesis explains why it is so hard to beat the market, while Anomalies identify strategies that do. Concepts like Quant Strategies and Factor Investing (including Smart Beta) make considerable use of anomalies.

- This online course is uniquely crafted by Deepak Mohoni, a well-known figure in Indian financial markets, who coined the term Sensex in 1989 in his column with Business World.

- An alumnus of IIT Kanpur and IIM Calcutta, Deepak combines decades of financial expertise with an active role in software development. Recently, he introduced the Quant Dashboard, and more innovative tools to support data-driven investing are in development.

- Deepak also wrote a widely followed weekly column in The Economic Times, appeared daily on leading business channels such as CNBC TV18 and ET Now, and was often quoted for his market insights by newspapers, including international publications such as the Financial Times and Asahi Shimbun.

- His contributions to media, including expert sound bites and interviews, established him as a trusted voice in Indian financial markets.

- He has conducted over 150 workshops for investors, including in-house sessions for companies such as ICICI Securities, DSP Merrill, Kotak Securities, and Motilal Oswal, along with educational institutions such as IIT Kanpur, IIM Ahmedabad, Symbiosis, and NIBM. Over 3,000 investors have gained valuable insights from his workshops and lectures.

- Throughout the course, you will have one-on-one access to Deepak, who will personally answer all your questions.

- Beginners. The course is perfect for beginners as they do not have to unlearn anything. The material is explained in a way which requires no prior knowledge.

- Seasoned Investors. Even if you've been investing for years, this course will challenge assumptions, refine strategies, and introduce evidence-based methods to drastically improve results.

- Traders. Learn to trade systematically, replacing impulsive decisions with a structured approach, and master how much to risk on each trade for best results.

- Retirement and FIRE Planners. For those nearing retirement or pursuing financial independence, this course helps you build a balanced, low-risk portfolio for steady growth. Secure your future with evidence-based strategies tailored to your goals.

- DIY Investors. Prefer managing your own portfolio instead of relying on advisors? Learn techniques and tools that make do-it-yourself investing smarter and more efficient.

- Coders. Ask for free guidance on coding resources, packages, and system implementation. Convert strategies into trading systems!

- Busy Professionals. Can create an investing plan that minimizes effort while delivering returns consistent with their goals.

- Families. This course is perfect for families managing wealth together or couples planning for shared financial goals. Build a strategy that works for everyone.

- Teachers and Educators. If you run market-related courses, this course shows how your methods compare against rigorous scholarly testing, helping you enhance lessons and give your students a robust edge.

- The course is self-paced, meaning you can view the material whenever it suits you—there are no scheduled sessions or deadlines.

- This flexibility allows you to proceed at your own speed, taking breaks whenever needed or moving faster than the default timeline, with all posts and materials sent directly via email.

- Typically, it takes a little over 12 weeks at around 20-30 minutes a day, but you can finish it in less than half the time or go much slower if you have other commitments.

- Throughout the course, Deepak will be available to personally answer any questions you have, ensuring you get the most out of every section and concept.

- Live exercises using actual stock data (paper trading only!) and quizzes are integrated to reinforce learning and provide hands-on experience with the strategies discussed.

- Additional lessons on mathematics, statistics, or other relevant topics are available on demand, and you can also ask for extra material on topics that interest you more.

-

Registration Details

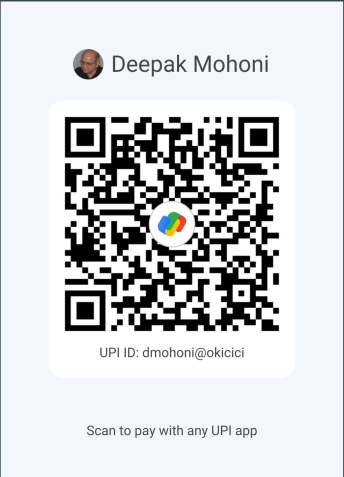

To register, please fill out the form below and complete your payment.

Fees: ₹28,000Please ensure you include your payment details in the Message box of the form.

Payment Options

🇮🇳 To Pay within IndiaEasiest MethodUPI: dmohoni@okicici

✈️ To Pay from Abroad

✈️ To Pay from AbroadIf you have an India account, please use UPI for your payment. Detailed instructions are available in the "To Pay within India" Section.

For international transfers, we recommend a transfer service like Wise over your bank. Regular international bank transfers are cumbersome, slow, and costly, and the amount credited is typically less than the actual course fees, delaying your start.

Wise is a secure, fast transfer service, regulated globally, that offers lower costs and better exchange rates. It was formerly known as TransferWise.

🔔 If you prefer a bank transfer or are paying from outside India, please ask us for our bank details!.

Registration Form

COURSE DETAILS

WHAT YOU WILL LEARN

➡️ For detailed content and syllabus, please click here to download the brochure.

MEET YOUR INSTRUCTOR