TRADING & INVESTING STRATEGIES

Online Course

REGISTER NOW

MARKETS

-

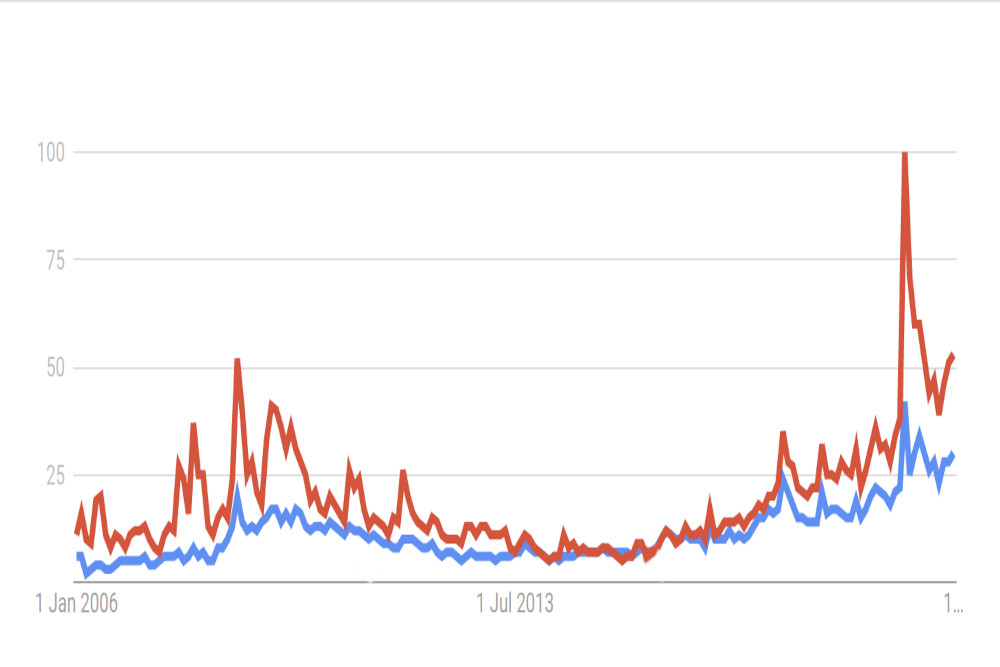

The unexpected "indicator" that caught the October 2008 and March 2020 major market bottoms

Besides price and fundamental data, there is a treasure trove of quantitative information about investor psychology that can be used for trading. We cover this in Course & Anticourse.

-

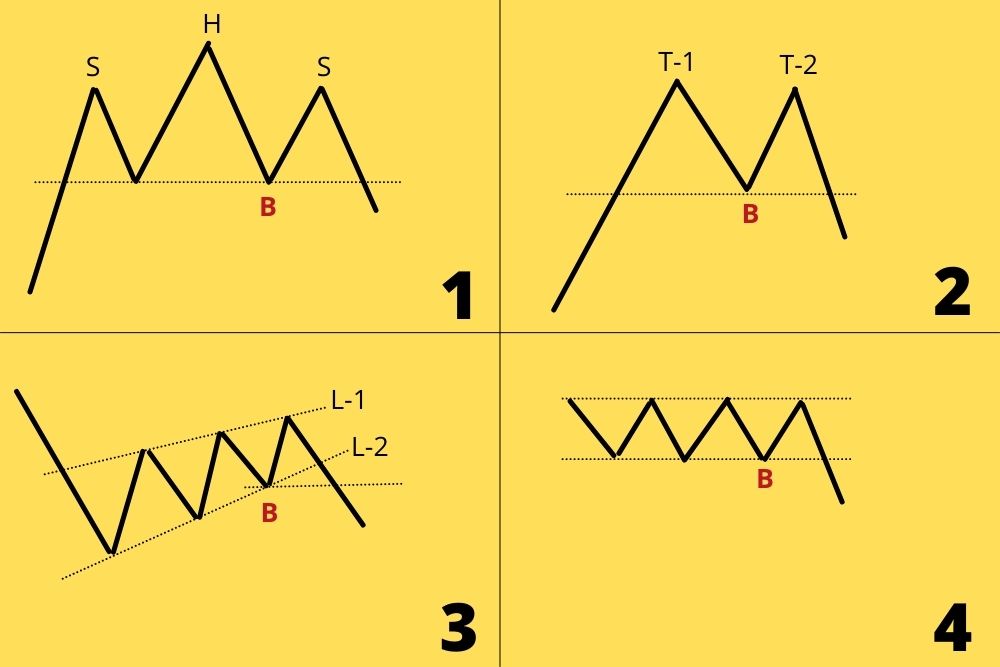

Technical Analysis : You need just one chart pattern!

Technical Analysis provides several chart patterns. These are largely redundant.

-

BLOG UPDATES SOON!

This includes all the pages which have extensive data in them!

-

Volume Ratio - a piece of the market puzzle

Price and volume have always been of interest to traders, but that basic data conceals much more information than it reveals. The Volume Ratio is one such piece of the bigger market puzzle.